Lithium Discoveries More Valuable Than Ever

Written by

Robin Lefferts

Published on

Feb 22, 2023

Last updated

Apr 26, 2023

Lithium prices sit far higher now than they did at the start of 2021. New production isn’t keeping up with greatly increasing demand, fueled in large part by the need for lithium-ion batteries for electric vehicles and green energy projects. With China controlling a large percentage of the world’s lithium supply, as well as its lithium processing capacity, the metal is now a focus of western governments as a mineral critical to national security.

At the same time, major lithium customers are seeking to secure their own supply as they boost production of electric vehicles. Ford has been signing off-take and supply agreements with miners around the world. GM recently took it a step further, committing to a staged and conditional investment of $650 million in the Thacker Pass lithium project in Nevada. GM hopes to secure enough lithium from Thacker Pass to supply 1 million new EVs each year. With the company already projecting production of 400,000 EVs in the first half of 2024, that supply will soon not be enough.

This convergence of national security, electrification, and constricted supply makes the discovery and development of new lithium sources all the more important, and potentially lucrative. It’s really a unique environment in the history of metal exploration, in some ways similar to a war time effort. Investors might be wise to identify some promising lithium projects still in the development phase. If a company can prove the lithium resource in the ground, and the area is reasonably accessible and appropriate for mining operations, it is more likely than ever there will be a competitive market for the potential lithium supply.

Argentina has perhaps the largest pipeline of lithium projects in the world, and an estimated 20 million metric tons of lithium that has been identified to date. Production is from dry lake beds or salars, which host below surface salt brines that contain lithium. The brine is pumped to the surface and evaporated into a concentrate. The concentrate is then processed into various forms of lithium, mainly battery grade lithium carbonate. There has been a flurry of acquisitions there, and that trend is very likely to continue. Here we’ll take a look at one very interesting company in the region, Lithium South Development Corporation (TSX-V: LIS) (OTCQB: LISMF). Lithium South holds five claims prospective for lithium, and is now drilling the largest claim block in the package.

Location, Infrastructure, Resource

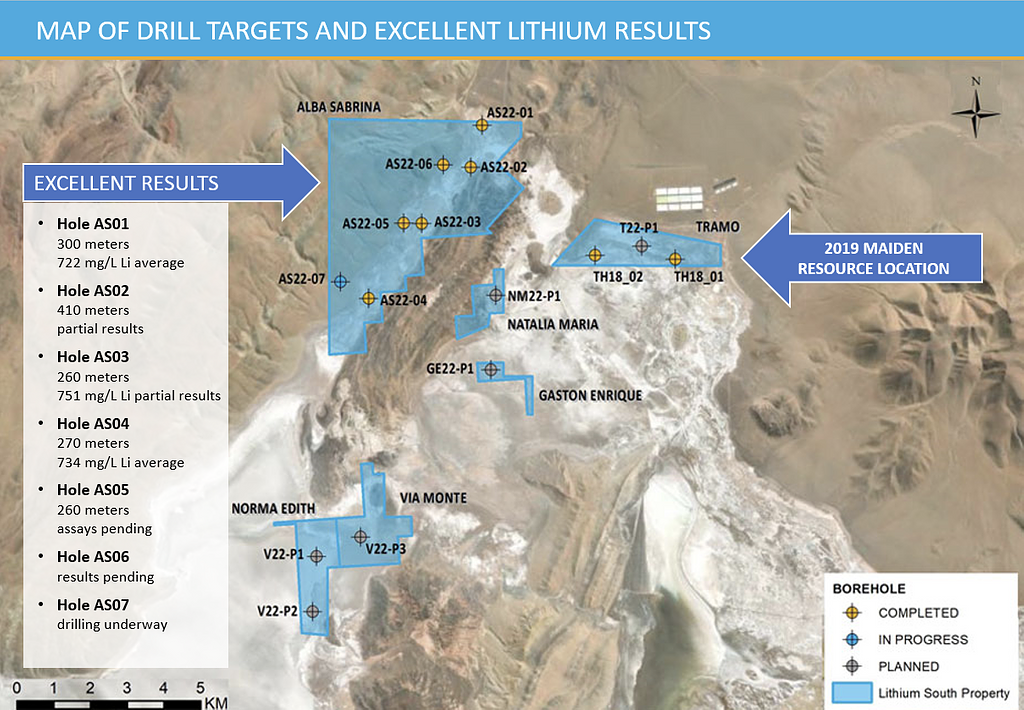

Lithium South owns a total of 5,687 hectares located at the Hombre Muerto Salar in Salta Province, Argentina. LIS is furthest along on two of its claims, the Tramo and Alba Sabrina claim blocks. These two blocks cover more than half of the company’s 3,287 salar-located claim package, all 100% owned by the company. The claims, highlighted in blue on the map below, are surrounded by both producing and prospective lithium properties, and the area has seen several acquisitions over the last few years.

Lithium South has already drilled a measured and indicated resource of 571,000 tonnes lithium carbonate equivalent (LCE) on the smaller Tramo project, which represents only 14% of the total available salar area shown above. It is now in the process of drilling the larger Alba Sabrina claim block with the intent of greatly expanding the company’s overall lithium inventory. In 2019, Lithium South (at the time called NRG Metals) completed a Preliminary Economic Assessment (PEA) based on the Tramo resource, and is looking to update that with new findings from the Alba Sabrina exploration program. Drilling on that block should be completed soon, and positive partial results have recently been reported. LIS President and CEO Adrian F. C. Hobkirk stated, “Hole AS02 is the deepest hole completed to date at the HMN Li Project and demonstrates the potential to significantly expand the total resource for the project. We are very pleased with the high lithium and low magnesium values.”

Lithium South anticipates that drill completion and assay results will be followed shortly by an updated NI 43-101 Resource Study. That report will then feed into a new PEA that incorporates both claim blocks and the new resource. This will potentially allow for a much larger operation as the original PEA is for a 5,000 tonne per year operation. LIS seeks to increase that throughput substantially.

At the same time, LIS is completing construction of a pilot plant to test evaporation characteristics on site. The current business plan is to concentrate a lithium solution on site and then truck off site to a location where water and energy are available at a lower cost. However LIS is also evaluating the Sophia claim blocks, located off the salar, as a potential water source. Upon completion of the current resource expansion drilling, LIS will site pumping wells for long term test work and potential future production. It’s a very busy time for Lithium South, but all of these steps feed into a comprehensive Feasibility Study that is anticipated by the end of 2023.

These feasibility studies evaluate whether a mining project is economically and technically possible, how much investment it requires, what operations are involved, what legal obligations there are, and how long it will take to complete. In short, Lithium South will know all the parameters of a potential lithium mine on site. At that point, the rubber will likely meet the road on the project.

The Upshot

Will Lithium South develop its own mine? Will it partner on a joint venture? Will it sell the assets to a major mining company, or to a company looking to secure its own source of lithium? Right now we don’t know the answer. Historically, it has proven difficult for junior miners focused on exploration and discovery to go it alone in building a mine. And the current dynamics of the lithium market point toward some kind of partnership or exit.

Time will tell, but that time is growing shorter for Lithium South. 2023 should be a year full of steady progress and announcements as the company approaches the Feasibility Study. If the resource proves out the way Lithium South anticipates, the company’s current ~$40 million market cap could adjust to a level in line with LIS peers.

Lithium South properties border directly on POSCO Holdings property, and POSCO is investing just over $1 billion into a lithium processing and commercialization factory there with the intent of becoming the world’s third largest battery-grade lithium producer in the world by 2030. It’s a nice neighbor to have, and the investment certainly highlights the value of lithium production in the area. POSCO, a South Korean steelmaker, bought the mining claims surrounding LIS in 2018 for $280 million. Prices for lithium have greatly appreciated since 2018, but as a reference (according to the press release linked above) POSCO bought 1.58 million tonnes of measured and indicated LCE resource in the deal, with another 0.96 million tonnes potentially inferred.

Lithium South is looking to expand on its current measured and indicated resource of 0.571 million tonnes located on the smaller Tramo claim block. Recent assay results from the 400 meter hole AS02, the deepest hole of the Alba Sabrina program so far, indicate there is excellent expansion potential. With its current drill program on the larger Alba Sabrina tract nearing completion, investors should have a pretty good idea of the new resource in the next couple of months following the imminent drill results and updated NI 43-101 Resource Study. Keep an eye out for further developments.

The Technical and Scientific content of this advertisement was reviewed and approved by Mr. William Feyerabend, a Consulting Geologist and Qualified Person under National Instrument 43-101.

Reference for PEA NI 43-101 PRELIMINARY ECONOMIC ASSESSMENT REPORT for the HOMBRE MUERTO NORTE PROJECT SALTA PROVINCE, ARGENTINA August 9, 2019, by Knight Piesold Ltd. and JDS Engineering and Mining Inc.

Disclaimer: TDM Financial is paid a fee of $ U.S. 7,000 per month by Lithium South Development Corp (LIS) for advertising consultation. TDM Financial produced this advertisement on behalf of LIS and as such it should be considered advertising. Nothing written in this advertisement is meant to facilitate a trade in the shares of LIS, and is not to be considered investment advice. This advertisement is published for information purposes only and the reader is encouraged to do his/her own due diligence regarding LIS.

This advertisement contains certain “forward-looking statements” within the meaning of Section 21E of the United States Securities and Exchange Act of 1934, as amended. Except for statements of historical fact relating to the Company, certain information contained herein constitutes forward-looking statements. Forward-looking statements are based upon opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors which could cause actual results to differ materially from those projected in the forward-looking statements. The reader is cautioned not to place undue reliance on forward- looking statements. We seek safe harbor.